The Customer Data Platform market hit $10 billion in 2025, yet Gartner’s research reveals a brutal truth: Only 17% of marketers report “high utilization” of their CDP investment.

That’s 83% of organizations with expensive data infrastructure that doesn’t deliver promised value.

The problem isn’t the technology. It’s the fundamental misunderstanding of what CDPs should actually do in 2025.

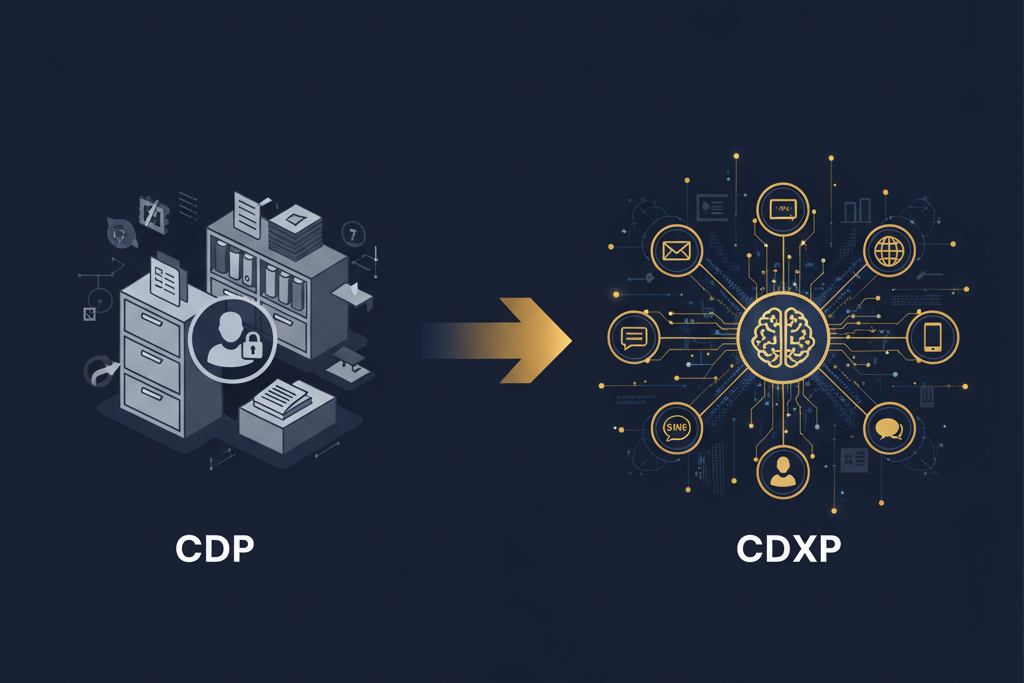

While most companies treat CDPs as glorified data warehouses, leading organizations evolved their platforms into something entirely different: Customer Data Experience Platforms (CDXPs)—systems that don’t just store data, but orchestrate entire customer experiences.

The $10 Billion Utilization Problem

According to multiple 2025 market analyses, the CDP market reached $10.02 billion (Straits Research) with projections ranging from $12.96 billion to $37.11 billion by 2030-2032, depending on measurement methodology. MarketsandMarkets forecasts 30.7% CAGR, while Mordor Intelligence reports 23.47% CAGR.

Yet despite this explosive growth, the CDP Institute’s July 2025 update reveals troubling patterns:

- Organic employment growth: Only 3.4% (best since 2022, but still minimal)

- Funding remained scarce: Just two funding events during the period

- Acquisitions surged: Six CDP acquisitions in one reporting period

- Market consolidation: Established platforms absorbing

CDP functionality

Translation: The standalone CDP market is contracting while CDP capabilities integrate into broader experience platforms.

Why Traditional CDPs Fail: The Data Repository Trap

Most organizations approach CDPs with a fatal misconception: They believe unified customer data automatically creates value.

The typical CDP implementation:

- Integrate data sources from multiple touchpoints

- Create unified customer profiles (the “360-degree view”)

- Make data available to marketing teams

- Expect magic to happen

What actually happens: Marketing teams get access to comprehensive customer profiles but lack the orchestration capabilities to act on that data effectively across channels. The CDP becomes an expensive data lake that nobody knows how to activate.

Gartner’s research confirms this: When asked about key technologies supporting journey orchestration, few business users mentioned CDPs as their primary tool. The platforms excel at data unification but fail at experience delivery.

The CDXP Evolution: From Data to Experience

Leading organizations recognized this gap and evolved their approach. Instead of viewing CDPs as data repositories, they transformed them into experience orchestration engines—Customer Data Experience Platforms.

The critical distinction:

Traditional CDP:

- Collects and unifies customer data

- Creates comprehensive customer profiles

- Makes data available to other systems

- Passive data storage and organization

Customer Data Experience Platform (CDXP):

- Collects and unifies customer data (baseline)

- Activates data in real-time across all channels

- Orchestrates personalized experiences automatically

- Predicts next-best actions using AI

- Measures and optimizes experience outcomes

- Active experience delivery and optimization

Bloomreach’s 2021 acquisition of Exponea explicitly positioned the combined platform as a CDXP rather than traditional CDP, recognizing that data unification alone doesn’t drive revenue—experience orchestration does.

The 2025 CDP Market Reality: Three Dominant Trends

1. Composable CDP Architecture Surge

Composable CDPs grew at 12.9% organic rate according to CDP Institute, though they still represent under 5% of total CDP employment. These platforms sit on top of existing data warehouses (Snowflake, BigQuery, Databricks) rather than requiring data duplication.

Why composable matters:

- Eliminates data duplication costs

- Reduces implementation time by 40-60%

- Maintains data governance in existing infrastructure

- Enables “zero-copy” activation where data stays in warehouse

Companies like Hightouch, RudderStack, and native Snowflake CDPs lead this evolution, giving enterprises flexibility to scale while maintaining control over sensitive customer data.

2. AI-Powered Predictive Engagement

72% of companies now prioritize first-party data strategies (Tealium’s 2025 Future of Customer Data Report), with 84% leveraging real-time CDP activation for engagement.

AI transforms CDPs from reactive to predictive:

- Identity resolution: AI spots connections between fragmented profiles with 95%+ accuracy

- Predictive segmentation: Anticipates customer needs before they arise

- Next-best-action: Recommends optimal engagement timing and channel

- Content generation: Creates personalized messaging at scale

- Churn prediction: Identifies at-risk customers 30-90 days in advance

Healthcare provider Innovaccer’s $275 million Series F (January 2025) validates investor belief in AI-ready CDPs that merge EHR, claims, and device feeds for proactive patient engagement—demonstrating 30-50% drops in administrative workload.

3. Industry-Specific CDP Specialization

Generic CDPs struggle to deliver value because industry requirements vary dramatically. 2025 sees rapid growth in vertical-specific platforms:

Healthcare CDPs:

- HIPAA compliance built-in

- EHR integration capabilities

- Predictive care gap analysis

- Automated patient outreach

- Market: $998.3 million in 2024, 18.2% CAGR to 2034

Financial Services CDPs:

- Real-time fraud detection

- Regulatory compliance (GDPR, CCPA, DPDP)

- Cross-product recommendation engines

- Risk-based customer segmentation

Retail CDPs:

- Real-time inventory integration

- Omnichannel attribution modeling

- In-store and online behavior unification

- Voice commerce integration

Industry-specific platforms reduce implementation time by 60-70% because compliance frameworks, data models, and activation patterns come pre-built for sector requirements.

The Hybrid Architecture Advantage

2025’s breakthrough: Hybrid CDPs that combine packaged solutions with composable flexibility.

Traditional debate:

- Packaged CDPs: Fast deployment, limited customization

- Composable CDPs: Maximum flexibility, longer implementation

Hybrid approach:

- Pre-built identity resolution and segmentation

- Composable activation layer for custom workflows

- Data stays in existing warehouse

- Industry-specific templates for common use cases

This architecture delivers 25-35% gains in inventory turnover and customer satisfaction because every channel receives up-to-date context without data latency.

Real-World CDXP Implementation: Telecommunications Use Case

GSMA Intelligence predicts 1 billion eSIM smartphone connections globally by end of 2025. Progressive telecom operators use CDXPs to transform this into revenue opportunities.

The scenario: When real-time CDP detects customer activating eSIM in foreign country, system immediately recognizes high roaming charge risk. Understanding that 53% of customers switch providers due to poor service experiences (Infobip), the CDXP:

- Identifies context: Customer location change via eSIM activation

- Predicts need: High roaming charges likely

- Calculates offer: Tailored international data plan from local carrier

- Orchestrates delivery: In-app notification + SMS simultaneously

- Measures outcome: Acceptance rate, revenue impact, satisfaction score

Result: Proactive engagement prevents dissatisfaction while creating upsell opportunity—simultaneously improving experience and generating revenue.

This is impossible with traditional CDP. The data might exist, but the real-time activation, predictive logic, cross-channel orchestration, and outcome measurement require CDXP capabilities.

The Composable vs. Packaged Decision Framework

Choose Composable CDP when:

- ✅ Existing data warehouse investment (Snowflake, BigQuery, Databricks)

- ✅ Complex, custom activation requirements

- ✅ Strong technical team with data engineering capabilities

- ✅ Mature data governance already established

- ✅ Budget for 6-12 month implementation

Choose Packaged CDXP when:

- ✅ Need rapid deployment (under 90 days)

- ✅ Standard use cases (e-commerce, content, lead nurture)

- ✅ Limited technical resources

- ✅ Immediate experience orchestration required

- ✅ Industry-specific compliance needs

Choose Hybrid when:

- ✅ Want both speed and flexibility

- ✅ Need pre-built vertical templates

- ✅ Existing warehouse but limited customization needs

- ✅ Scaling from pilot to enterprise deployment

60% of organizations plan to invest in composable enterprise technology within three years (Gartner 2022 CIO Survey), but packaged solutions still dominate actual deployments due to faster time-to-value.

The Experience Orchestration Imperative

CDPs solve data unification. CDXPs solve customer engagement.

The fundamental shift: Stop asking “How do we create better customer data?” Start asking “How do we orchestrate better customer experiences?”

CDXP use cases delivering measurable ROI:

Churn Reduction:

- Predictive models identify at-risk customers

- Automated win-back campaigns across email, SMS, in-app

- A/B testing of retention offers

- ROI: 15-25% churn reduction (typical)

Revenue Per Customer:

- AI-powered cross-sell recommendations

- Real-time product bundling based on browsing

- Cart abandonment orchestration

- ROI: 10-20% revenue lift per customer

Marketing Efficiency:

- Eliminate duplicate customer outreach

- Channel preference optimization

- Budget allocation based on predicted conversion

- ROI: 30-40% reduction in wasted spend

Customer Lifetime Value:

- Cohort analysis with predictive modeling

- Automated lifecycle nurture programs

- VIP customer identification and treatment

- ROI: 20-35% LTV increase for targeted segments

The Privacy-First CDXP Architecture

Data privacy isn’t a constraint, it’s a competitive advantage in 2025.

GDPR 2.0 and DPDP 2025 compliance drivers:

- Stricter consent requirements across all channels

- Right to deletion within 30 days

- Data minimization mandates

- Cross-border transfer restrictions

How leading CDXPs address privacy:

1. Consent Management Integration

- Real-time consent status across all touchpoints

- Automatic suppression of non-consented data

- Audit trails for compliance reporting

- Granular permission controls

2. Privacy-Enhancing Technologies (PETs)

- Differential privacy for aggregate analytics

- Homomorphic encryption for secure computation

- Federated learning for AI without data centralization

- Synthetic data generation for testing

3. Data Minimization by Design

- Automatic data expiration policies

- Purpose limitation enforcement

- Progressive profiling strategies

- Anonymization at collection

Allianz Insurance demonstrates this approach: Implementing homomorphic encryption and differential privacy across European operations, analyzing 50+ million customer records while maintaining GDPR compliance, resulting in 38% improvement in cross-selling effectiveness (Allianz Digital Transformation Report 2023).

The Migration Path: CDP to CDXP

Most organizations can’t rip-and-replace existing CDP investments. The practical evolution:

Phase 1: Audit Current Utilization (Months 1-2)

- Measure actual CDP usage across teams

- Identify activation gaps and manual workarounds

- Calculate true cost per activated customer

- Document desired but unavailable capabilities

Phase 2: Layer Experience Capabilities (Months 3-6)

- Add journey orchestration platform on top of CDP

- Integrate AI/ML models for predictions

- Connect all activation channels (email, SMS, push, web, ads)

- Build first automated experience flows

Phase 3: Optimize and Expand (Months 7-12)

- A/B test orchestrated vs. manual campaigns

- Train teams on experience-first workflows

- Expand use cases beyond marketing

- Measure experience ROI, not just data quality

Phase 4: Full CDXP Transformation (Year 2+)

- Consider migration to integrated CDXP platform

- Or maintain hybrid with best-of-breed components

- Scale successful patterns across organization

- Build experience orchestration as core competency

The 2025 Vendor Landscape: Who’s Leading

Traditional CDP Vendors Evolving:

- Salesforce: Acquired Tableau, MuleSoft—building comprehensive experience cloud

- Adobe: Experience Platform integrates Firefly generative AI for content creation

- Oracle: Unity CDP with Fusion Analytics for predictive insights

- SAP: Emarsys Customer Engagement focuses on e-commerce activation

Composable CDP Leaders:

- Hightouch: Warehouse-native, zero-copy architecture

- RudderStack: Event streaming with reverse ETL

- Snowflake: Native apps within Snowflake environment

- Databricks: Lakehouse-based CDP capabilities

Emerging CDXP Players:

- Bloomreach: Exponea acquisition creates content + data + commerce platform

- BlueConic: Pure-play CDP with strong activation focus

- Tealium: Real-time capabilities with extensive integrations

- Segment: Twilio-owned, developer-focused composable approach

Vertical Specialists:

- Innovaccer: Healthcare-specific with EHR integration

- Treasure Data: B2B focus with ABM capabilities

- Blueshift: AI-native with strong prediction engines

Market consolidation continues: Contentstack acquired Lytics (2025), ActionIQ purchased by Uniphore reflecting trend toward integrated experience platforms rather than standalone CDP tools.

The Bottom Line: Data Doesn’t Create Value, Experiences Do

The CDP market reached $10 billion in 2025, yet 83% of deployments fail to deliver high utilization.

The companies succeeding aren’t building better data warehouses. They’re orchestrating better customer experiences.

The strategic imperative: Stop investing in customer data platforms. Start investing in customer data experience platforms.

The difference isn’t semantic—it’s the difference between data you can’t activate and experiences that drive revenue.

72% of companies prioritize first-party data strategies. 84% leverage real-time activation. The infrastructure exists. The buyer demand is proven.

The only question: Will your organization treat customer data as a repository to manage, or as an engine to orchestrate experiences that competitors can’t replicate?

The market has already decided. The CDXP evolution isn’t coming—it’s here.

BINOBAN helps enterprises transform CDP investments into CDXP capabilities that drive measurable experience outcomes. Ready to move beyond data unification to experience orchestration?