The $5.2B market isn’t waiting for perfect strategies

We’re three-quarters through, and the data monetization 2025 landscape has shifted dramatically. What started as a $4.15 billion market in 2024 has grown to approximately $5.2 billion in 2025—yet 68% of enterprise data still sits unused, according to the latest Seagate/IDC research.

The companies that moved fast in Q1 2025 are now seeing revenue. On the other hand, the ones still “planning” are watching market share disappear.

The Q4 2025 Market Reality

Current State:

- Global data monetization market: $4.7B-$5.2B (September 2025)

- Enterprise data growth: 42.2% annually (IDC)

- Unused data crisis: 68% unchanged from 2024 (Seagate study)

- SME adoption: 29.4% CAGR (fastest-growing segment)

What Changed in 2025: The early adopters aren’t experimenting anymore—they’re scaling. Manufacturing companies that launched sensor data licensing in Q2 are pulling in $400K+ annually. Retail chains monetizing customer journey data hit $250K in new revenue streams.

Meanwhile, enterprises still “evaluating” missed the first wave of a market projected to reach $12-41 billion by 2030.

The September 2025 Divide

Companies Monetizing Data in 2025:

- 25-40% higher margins than competitors

- New revenue streams worth $500K-$2M annually

- Customer insights driving 15-20% growth

- Market positioning competitors can’t replicate

Companies Still “Planning”:

- Same operational costs, shrinking margins

- Revenue streams stagnant or declining

- Competing on price instead of insight

- Watching market share transfer to data-first competitors

This isn’t theory anymore. The revenue gap is measurable. The competitive advantage is visible.

Real Q4 2025 Examples

Manufacturing Firm (Q2 2025 Launch):

- Operational challenge: 15% equipment downtime

- Solution: Predictive maintenance system

- Result: 6% downtime, $400K annual licensing revenue

- Internal benefit: 20% cost reduction

Logistics Company (Q3 2025 Launch):

- Asset: Route optimization data

- Product: Industry benchmarking service

- Revenue: $600K annually from subscriptions

- Internal lift: 12% operational cost reduction

Pattern: Start imperfect → Generate revenue → Improve iteratively

The Q4 2025 Sprint Framework

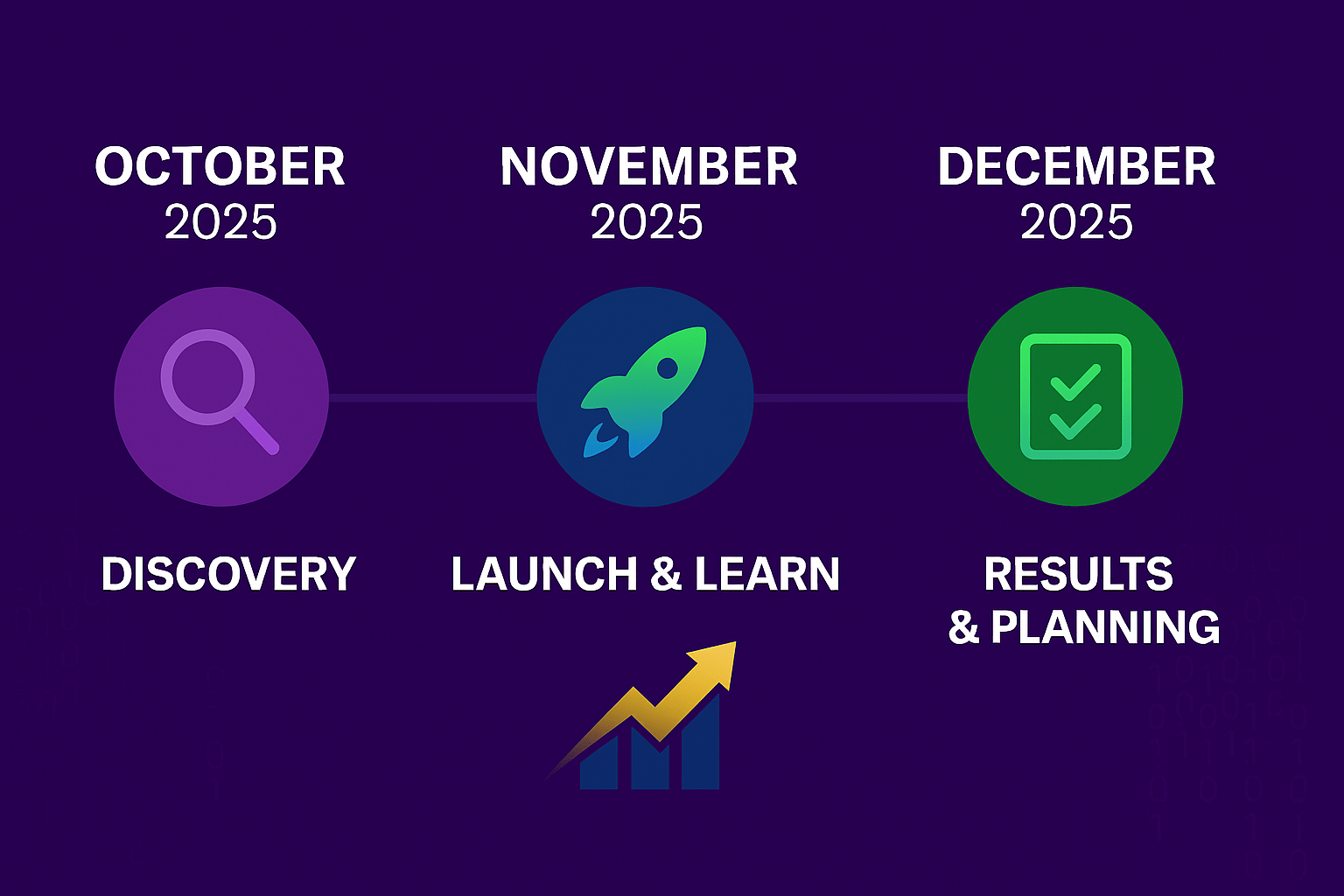

90 Days to Revenue:

October 2025: Rapid Discovery

- 10-day data asset audit

- Identify top 3 monetization opportunities

- Validate with potential buyers

- Build minimal viable data product

November 2025: Launch & Learn

- Deploy first pilot program

- Gather customer feedback

- Refine value proposition

- Scale what works

December 2025: Results & Planning

- Document proven ROI

- Plan 2026 expansion

- Build competitive moats

- Enter 2026 as a market player

Why Q4 2025 Matters

The Market Math:

- Current market: $5.2B (2025)

- Conservative projection: $12.46B by 2030 (21.12% CAGR)

- Aggressive projection: $41.25B by 2034 (25.82% CAGR)

The Competitive Reality: Companies joining the market in Q4 2025 enter 2026 as players. Companies are still planning to enter 2026 as spectators.

The Infrastructure Truth: Analytics-enabled platforms now represent 38-40% of market share. SO, the delivery infrastructure exists, and the buyer demand is proven. The only question is execution speed.

The Q4 2025 Choice

Scenario A: Data Revenue Generator by Dec 31

- $200K-$500K in Q4 data revenue

- 3-5 validated monetization streams

- Customer waiting list for 2026 expansion

- Competitive advantage competitors can’t copy

Scenario B: Still Planning

- Same revenue sources as January 2025

- Market opportunity 50%+ larger than when planning started

- Competitors with 12 months of monetization experience

- Explaining to stakeholders why you missed the $5.2B market

The Bottom Line

The data monetization market hit $5.2 billion in 2025 while 68% of enterprise data sits unused. This disconnect represents the biggest missed opportunity in business today.

SMEs are moving fastest at 29.4% CAGR because they’re more agile and less bureaucratic. Enterprises that don’t move in Q4 2025 will watch smaller competitors capture disproportionate value in 2026.

The market doesn’t reward perfection. It rewards participation.

90 days until 2026. What’s your move?

Sources: Precedence Research (July 2025), Mordor Intelligence (June 2025), Seagate/IDC “Rethink Data” study, Forrester Research, Grand View Research