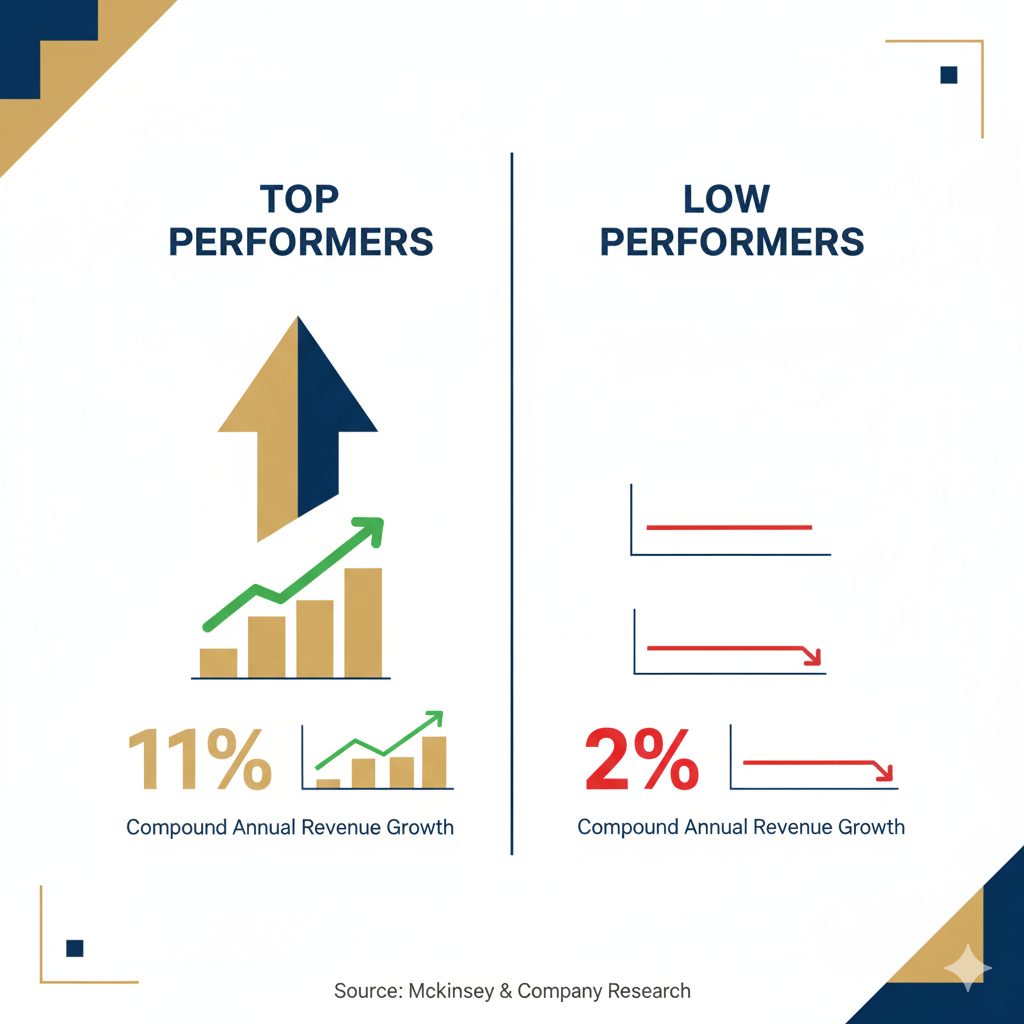

McKinsey’s latest research reveals how top performers generate 5x more revenue from data than competitors

McKinsey dropped a bombshell in July 2025: Top-performing organizations now attribute 11% of their revenue to data monetization—over five times more than their lower-performing peers.

Think about that. If you’re a $100M company, that’s $11M in revenue from data assets you already own. The gap between winners and losers isn’t closing—it’s exploding.

The catalyst? Generative AI has completely rewritten the rules of data monetization. The companies adapting to this shift are pulling away from their competition at unprecedented speed.

The Gen AI Data Monetization Shift

According to McKinsey’s November 2024 research with 349 senior leaders, a third of global executives believe their companies’ data assets have massive unrealized potential. They’ve invested heavily—built warehouses, created dashboards, embedded analytics—but far more value remains untapped.

Gen AI changed everything.

It’s no longer about monetizing raw data or even mining insights through traditional analytics. Gen AI is reshaping how enterprises generate value from large datasets entirely.

The fundamental shift: From selling data products to creating AI-powered intelligence at scale.

Bloomberg’s 40-Year Data Advantage

Bloomberg built BloombergGPT—a 50-billion-parameter large language model trained on 40 years of financial data from news archives, filings, and pricing models. This AI platform handles both dense structured datasets and vast unstructured textual information that Bloomberg collects.

The result: Proprietary financial intelligence that competitors can’t replicate, no matter how much money they throw at the problem.

Key insight: Bloomberg’s competitive advantage isn’t the data itself anymore—it’s the AI-powered intelligence layer built on top of that data.

Walmart’s Data Empire: Scale as Strategy

Walmart launched Scintilla, their proprietary data tool leveraging the world’s largest retailer’s scale of shopper data. As the 2025 top retailer per National Retail Federation data, Walmart possesses proprietary consumer behavior data that few competitors can match.

The strategic lesson: Companies designing clear roadmaps to identify where and how their data drives impact are positioned to succeed. The most successful data monetization efforts treat it not as a side project but as a vehicle for business building.

Reality check: 68% of enterprise data still sits unused according to Seagate’s 2025 study of 1,500 companies, even as the market grows to $5.2 billion.

The 2025 Market Reality: $5.2B and Accelerating

Recent market data from Precedence Research (July 2025) shows:

Global Market:

- 2024: $4.15 billion

- 2025: $5.2 billion

- 2034 projection: $41.25 billion

- CAGR: 25.82%

U.S. Market Specifically:

- 2024: $1.06 billion

- 2034 projection: $10.74 billion

- CAGR: 26.06%

North America dominance: 32.5% global market share, driven by advanced technology adoption and major banking, financial, and telecommunications sectors with massive customer data volumes.

The market isn’t just growing—it’s exploding. Companies moving now capture disproportionate value. Companies waiting watch opportunities evaporate.

Five Gen AI-Driven Monetization Trends

1. AI-Enhanced Privacy Preservation

Privacy legislation is driving innovation in Privacy-Enhancing Technologies (PETs), creating opportunities for privacy-first data monetization.

Industry example: Allianz Insurance implemented homomorphic encryption and differential privacy techniques across European operations, analyzing over 50 million customer records while maintaining GDPR compliance. Result: 38% improvement in cross-selling effectiveness without compromising personal data (Allianz Digital Transformation Report 2023).

The opportunity: Organizations can now monetize sensitive data that was previously locked away due to privacy concerns.

2. Real-Time Predictive Analytics

Advanced AI/ML models analyze and uncover specialized insights in real-time, enhancing decision-making speed and accuracy.

Industry example: Wells Fargo implemented ML-based fraud detection reducing fraudulent transactions by 35% while processing over 8 billion transactions annually. The system leverages federated learning to maintain data privacy across multiple jurisdictions (Wells Fargo Technology Innovation Report 2023).

The monetization angle: Real-time fraud prevention insights command premium pricing from financial institutions globally.

3. Subscription-Based Data Intelligence

Organizations create new revenue streams through subscription-based data access models, offering everything from anonymized datasets to API-based intelligence services.

Industry example: Walmart’s Data Ventures program monetized anonymized consumer behavior data, enabling CPG companies to optimize product placement and inventory management.

Pricing models observed:

- Basic API access: $10K-$50K monthly

- Advanced analytics packages: $50K-$200K monthly

- Custom intelligence solutions: $200K-$1M+ annually

4. Domain-Specific AI Models

Companies with proprietary data advantages train specialized AI models that competitors can’t replicate.

Strategic positioning: Bloomberg and Walmart demonstrate this perfectly—their AI models trained on decades of proprietary data create insurmountable competitive moats.

The barrier: You can’t buy or license your way into this advantage. You either built it over years, or you didn’t.

5. Self-Service Analytics Democratization

Advanced self-service analytics platforms transform how organizations extract value from data across all levels.

Industry example: Target Corporation deployed a self-service analytics platform enabling real-time decision-making across 1,900 stores.

Revenue impact: Democratized data access enables faster monetization cycles as more teams identify revenue opportunities.

Healthcare’s Data Monetization Explosion

Healthcare data monetization solutions reached $998.3 million in 2024 and is projected to grow at 18.2% CAGR through 2034, driven by electronic health records (EHR) adoption.

Real implementations (2024):

- Mayo Clinic: Anonymized patient records for clinical research using three proprietary data pipelines

- Cleveland Clinic: Seven data-sharing specialized projects in genomics

- Stanford Medicine: Nine AI-based clinical trial optimization programs

Japan’s market surge: Comprehensive real-world healthcare databases provide robust foundations for data-driven initiatives, with EHR adoption enhancing data value.

UK investment: £2 billion projected in digital healthcare, with £1.5 billion from private entities focused on predictive, preventative, personalized medicine.

The healthcare sector proves that even heavily regulated industries can monetize data profitably with proper compliance frameworks.

The Analytics-Enabled Platform Advantage

Analytics-enabled Platform as a Service dominates the market with the largest share, according to multiple 2025 market analyses.

Why this methodology wins:

- Provides customers flexible data monetization

- Enables BI and analytics capabilities

- Delivers real-time insights with high versatility

- Cloud-agnostic supporting diverse data formats

- Deployable on-premises or cloud

The challenge: Requires expert assistance for maintenance and installation, creating service revenue opportunities alongside data monetization.

Market position: As enterprises invest heavily in cloud-based solutions, demand for analytics-enabled platforms remains high.

Saudi Arabia’s National Data Strategy

Saudi Arabia established the Saudi Data and Artificial Intelligence Authority (SDAIA) and National Data Management Office (NDMO), enforcing comprehensive national data management framework spanning 15 key domains.

Focus areas critical for monetization:

- Business Intelligence and Analytics

- Open Data initiatives

- Data Value Realization programs

Private sector contribution: Careem collaborates with academic institutions analyzing spatiotemporal data, developing predictive models that monetize insights supporting urban planning and enhanced traffic management.

The lesson: National-level data strategies recognize monetization as economic development tool, not just corporate opportunity.

What Top Performers Do Differently

McKinsey’s research reveals that successful data monetization strategies start with sharp understanding of a company’s proprietary advantage. Whether privileged access to high-quality data, deep customer knowledge, or domain-specific infrastructure, data product strategies must be grounded in what makes the organization uniquely positioned to win.

The success pattern:

- Identify proprietary advantage (data access, customer knowledge, infrastructure)

- Design clear roadmap identifying where and how data drives most impact

- Treat as business building vehicle, not side project

- Invest in scalable AI tech stack with fit-for-purpose ecosystem

- Establish robust data governance and responsible AI practices

Critical foundation: Compliance, transparency, and trust are foundations for sustainable value creation.

The Implementation Reality

According to PwC Middle East’s four-step data monetization journey framework, business leaders must:

Step 1: Explore data as dynamic asset Data evolves and grows within organizations. It’s not static inventory.

Step 2: Define clear vision and goals Maximize benefits with well-defined execution plans.

Step 3: Establish organization-wide initiative

Data monetization isn’t an IT project—it’s a business transformation.

Step 4: Implement necessary monitoring Track progress against defined metrics continuously.

Investment reality: Six-figure budgets and 12-18 month timelines remain standard for successful implementations.

The Gen AI Monetization Framework

Based on analysis of successful 2025 implementations, here’s the proven approach:

Phase 1: Proprietary Advantage Assessment (Months 1-2)

- Identify unique data access or collection capabilities

- Evaluate domain expertise and customer knowledge depth

- Assess infrastructure advantages vs competitors

- Map data assets to potential market demand

Phase 2: AI-Powered Product Development (Months 3-6)

- Build specialized AI models on proprietary data

- Develop privacy-preserving technologies for sensitive data

- Create real-time analytics capabilities

- Design subscription and API-based delivery systems

Phase 3: Market Launch and Iteration (Months 7-12)

- Start with targeted buyer segments

- Implement robust governance frameworks

- Gather market feedback and iterate rapidly

- Scale successful products aggressively

Phase 4: Ecosystem Expansion (Year 2+)

- Develop partner network for data enrichment

- Create platform business models

- Build defensible competitive moats through AI advantages

- Expand into adjacent markets and use cases

The Bottom Line: 11% Revenue Gap

McKinsey’s research is unambiguous: Top performers generate 11% of revenue from data monetization—5x more than low performers.

With the market growing from $5.2 billion (2025) toward $41.25 billion (2034), the companies capturing this value are building insurmountable competitive advantages through Gen AI-powered data products.

The era of static data products is over. Gen AI isn’t just enhancing data monetization—it’s rewriting its rules entirely.

The strategic question: Will your organization be in the 11% revenue category, or watching competitors pull away with AI advantages you can’t replicate?

The choice is binary. The window is narrow. The payoff is massive.

BINOBAN helps enterprises identify their proprietary data advantages and build AI-powered monetization strategies that capture market-leading revenue. Ready to join the top performers generating 11% of revenue from data?